Ilmenite project

Recovering ilmenite from tailings sand

Extraction of valuable minerals from tailings pond

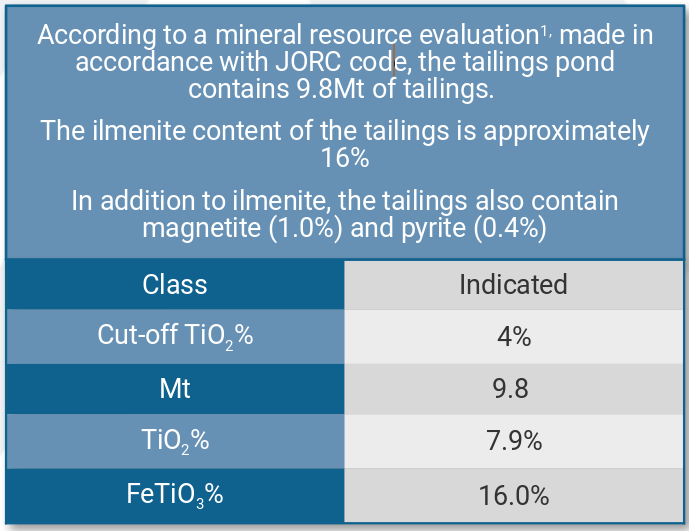

The Company has acquired the old mine’s tailings pond which contains surplus mineral matter left over from when the mine was still operational back in 1985. The formerly untapped tailings still contain financially profitable quantities of ore minerals (magnetite, ilmenite, and pyrite). The size of the tailings pond is approximately 145 hectares, and is located about two kilometres to the north of the Otanmäki community. The pond contains approximately 9.8Mt of tailings, which is sufficient for ilmenite production for around 6 to 7 years

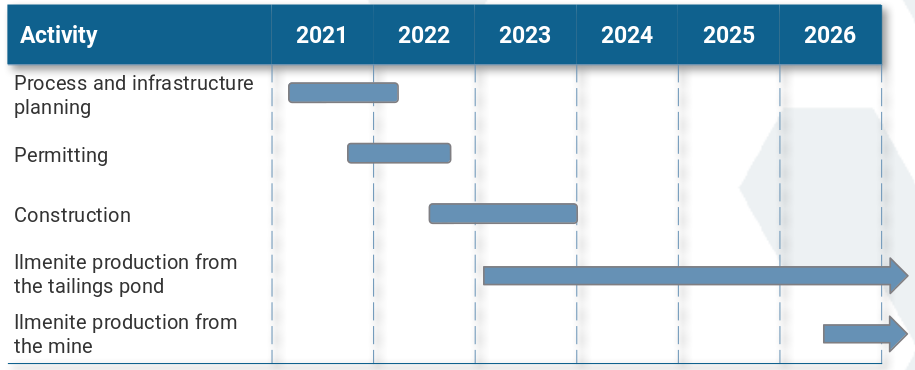

Otanmäki Mine is planning to start producing ilmenite by the year 2023. The Company estimates being capable of producing approximately 50 to 80Kt ilmenite per year at the beginning of production, and later approximately 130Kt per year

After tailings pond’s ilmenite is consumed, ilmenite production will continue from the mine

The mine’s yearly ilmenite production will be approximately 350 to 400Kt

Exploration and analysis of the tailings sand

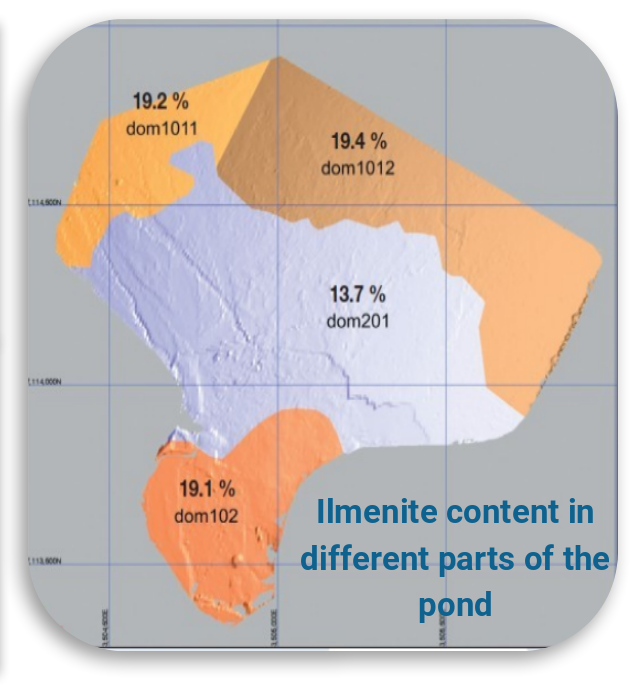

647 chemical analyses — the tailings’ ilmenite content is approximately 16%

245 grain size analyses — the grain size of the tailings is mostly under 0.5mm. At the southern end the material is clearly coarser than at the northern end of the pond

Based on the conducted studies it is concluded that ilmenite appears in its own separate grains, and its separation from other minerals is therefore possible using methods based on density differences and magnetic properties

A mineral resource estimate has been prepared based on the conducted studies

Mineral Resource Estimate

1) The mineral resource estimate was prepared by Geological Survey of Finland, GTK

Source: Otanmäki Mine Oy, GTK

Processing Tests

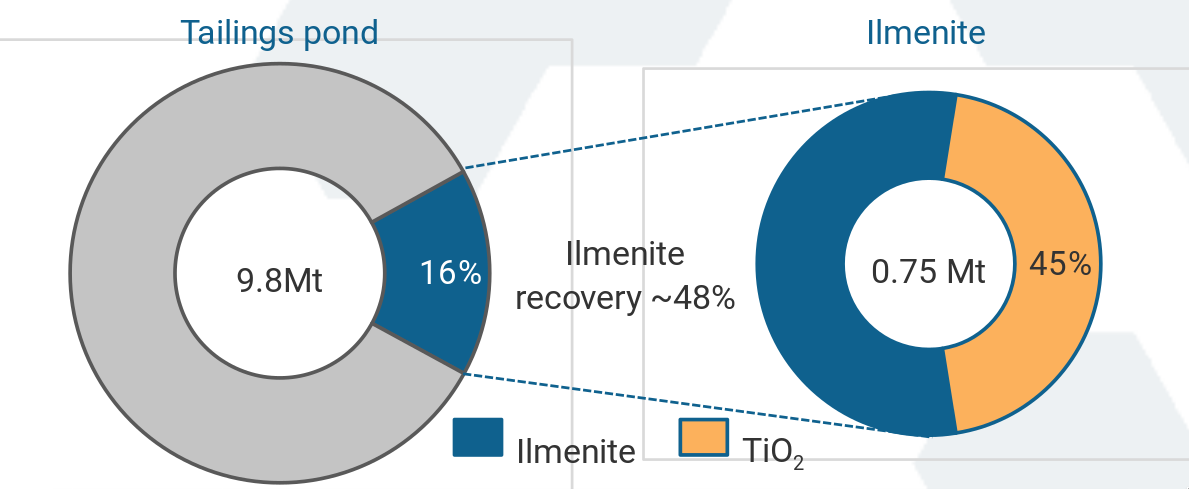

In December 2018, GTK Mintec studied ilmenite processing with alternative methods. The most favourable result was achieved with a combination of a spiral and a vibrating table, which indicates ilmenite recovery at 48%, and the TiO2 content of the ilmenite concentrate at 45%

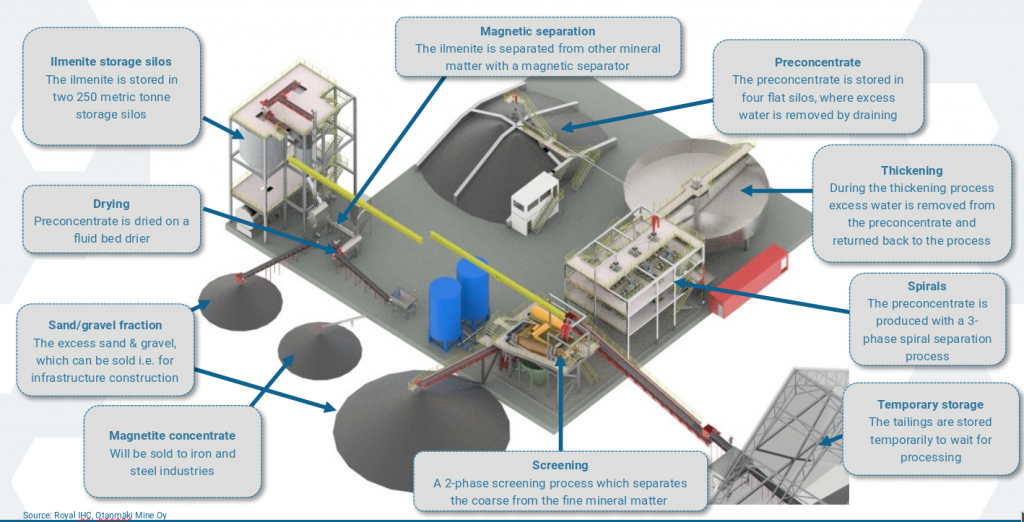

Ilmenite recovery process

• Ilmenite production will be based on a chemical free gravitational and magnetic process.

• The process utilizes globally known and commonly applied technologies, which reduce the technology risk for the Company and minimizes the ramp-up period.

• The process water used is obtained from the Otanmäki mine which contains around 8.5Mm3 of water.

• The process water is recycled through a large (approx. 190ha) settling pond and pumped back into the process. The aforementioned procedure minimizes the amount of water released into the environment by reducing all unnecessary outflows.

•The coarse mineral matter created in the ilmenite separation process will be sold to the infrastructure construction projects in the near region. The fine mineral matter is returned back to the tailings pond.

1.

Transportation

Transportation of tailings sand to the processing plant (outsourced)

2.

Screening

Removal of coarse material by screening

3.

Hydrocyclone

Removal of fine material (< 30 microns) by hydrocyclone

4.

Spiral separation

3-phase spiral separation, which produces pre-concentrate

5.

Drying

Drying of pre-concentrate

6.

Magnetic separation

High intensity magnetic separation, which produces the final ilmenite concentrate

7. Transportation

Transportation of ilmenite concentrate to nearest port (outsourced)

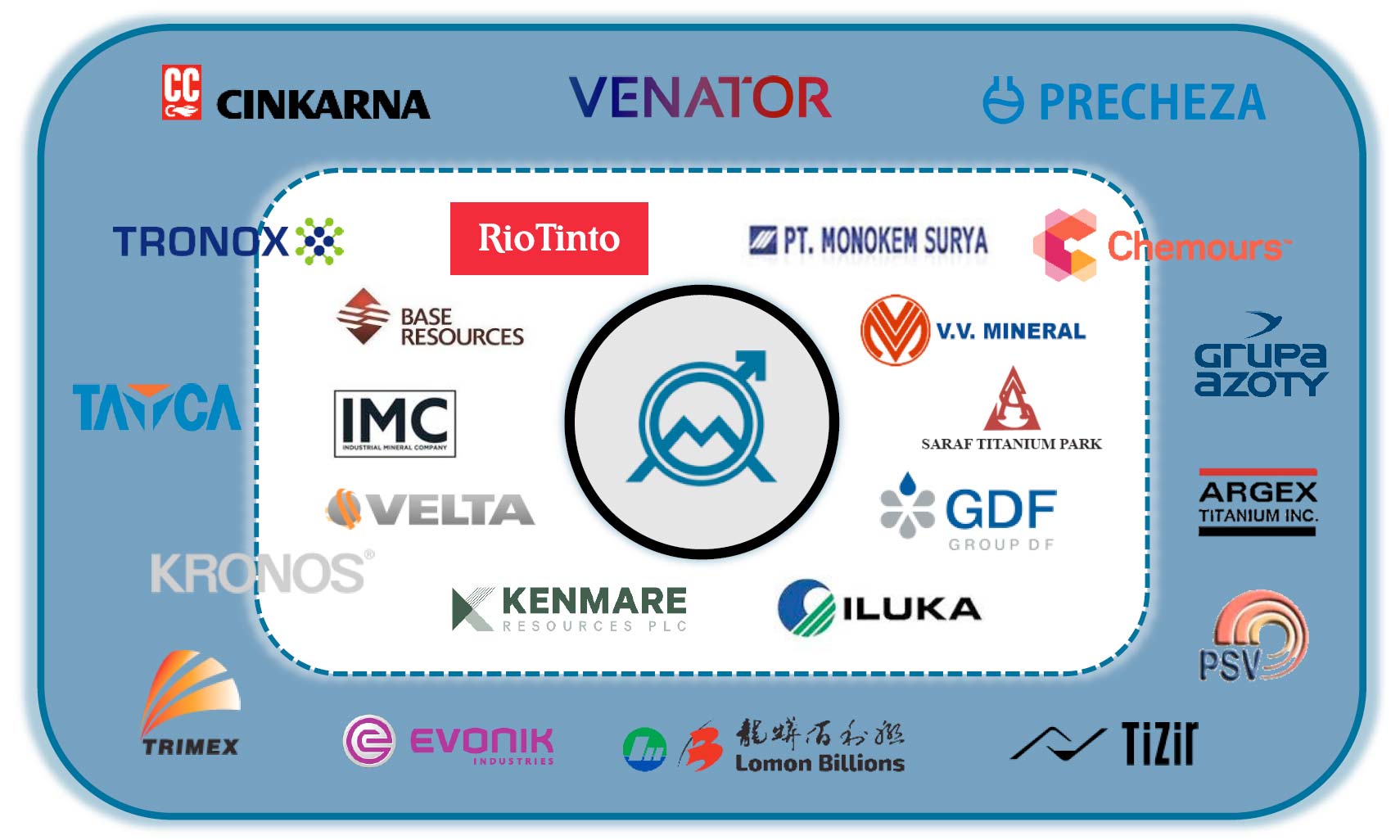

TiO2-Manufacturers

Titaanidioksidivalmistajat

Source: Royal IHC, Otanmäki Mine Oy

9,8 Mt

Tailings Sand

~ 16 %

Ilmenite grade in tailings sand

~ 45 %

TiO2-grade in ilmenite concentrate

€18,4m

Construction Costs

€129m

Market value of recovered ilmenite

Background

• According to research conducted by the Company, the ilmenite content of the tailings (9.8Mt) is approximately 16%. Furthermore according to tests performed by GTK’s Mintec laboratory, the process recovery rate is at least 48%, in other words ilmenite recovery from the tailings could be approximately 753 thousand metric tonnes.

• Considering that the titanium dioxide content of the refined ilmenite is approximately 45%, the current market value of the Otanmäki ilmenite is approximately €129 million.

• The Company assess being capable of processing at least 1.7Mt of tailings per year. Thus, at the above mentioned recovery rate, Otanmäki Mine’s yearly ilmenite production will be approximately 131Kt.

• Otanmäki Mine believes that by optimizing the refining process it is possible to raise the recovery rate to a level between 65 and 70%. This would mean that the yearly ilmenite recovery rate would increase to 156 – 168 thousand metric tonnes.

• Even with the 131 thousand tonne recovery, the yearly revenue of the ilmenite project would be approximately €22 million. With operative costs deducted, the Company’s yearly EBITDA percentage would settle around 69%.

• According to a process plan and investment requirement mapping performed by Royal IHC, the ilmenite project will required around €18.4 million in construction investments. Given that the Company is in the mining industry, the initial investments can be considered reasonable. The investments are long term in nature, as the buildings will also be utilized in future ilmenite production from the mine.

• Required permitting procedures will be initiated during 2021. The most essential permits include construction and environmental permits.

Project Timeline

Production Assumptions

Mineral Resource (Mt) | 9,8 |

Ilmenite Production (t/a) | 130 560 |

Magnetite Production (t/a) | 14 450 |

Production Period (years) | 6,8 |

CAPEX (€m) | 18,4 |

Total Turnover (€m) | 128,6 |

Ilmenite Market

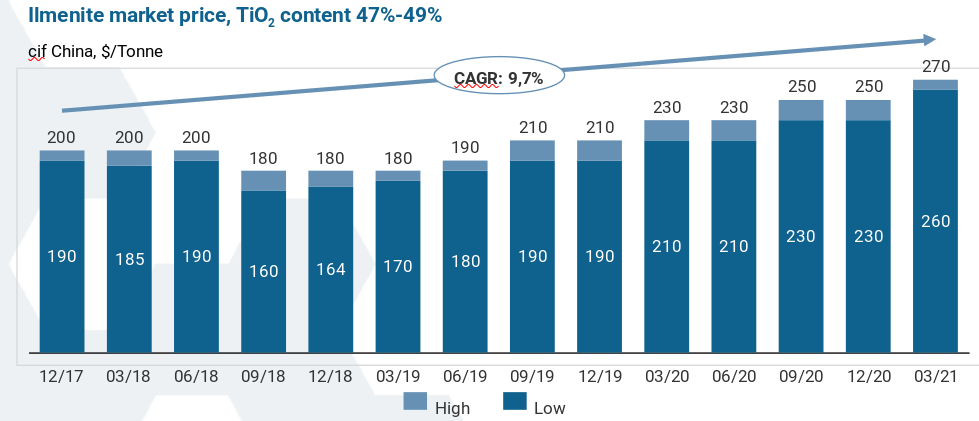

Ilmenite price has risen on average 9.7% annually during the last 3 years.

Ilmenite Supply and Demand

Ilmenite Price and Supply

• During the last three years (December 21, 2017 to March 25, 2021), the market price of ilmenite, with a TiO2 content of 47 – 49%, has increased at an annual growth rate of approximately 9.7%-10.1% (High; Low).

• In this short evaluation window, the market price of ilmenite has varied as follows:.

• Low (TiO2 content 47%): USD/tonne 160 – 260; annual volatility c. 11.5%1.

• High (TiO2 content 49%): USD/tonne 180-270; annual volatility c. 10.8%.

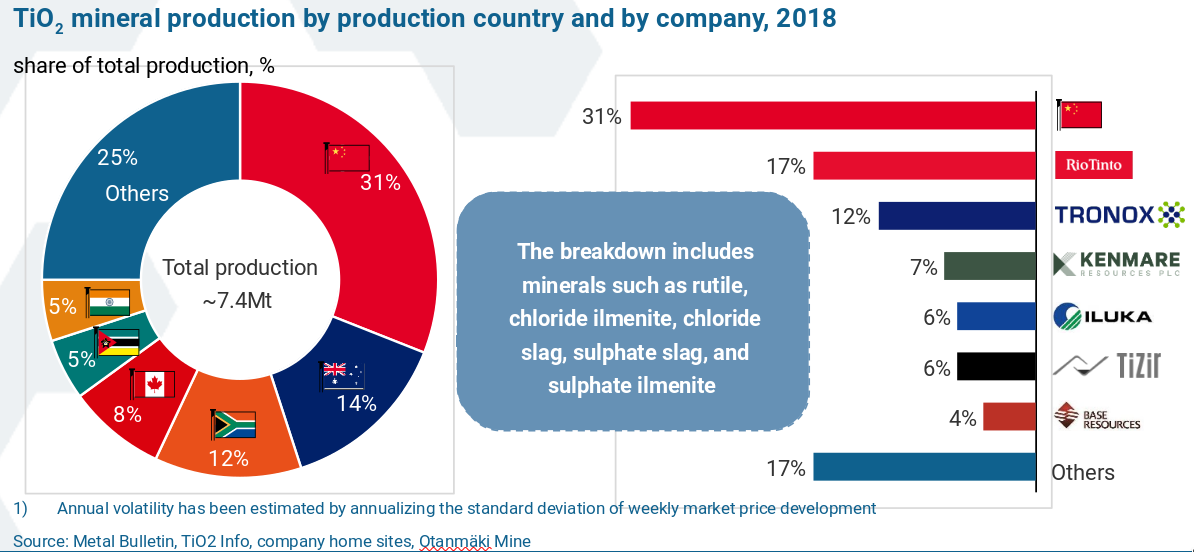

• In 2018, the global production of titanium dioxide minerals (incl. ilmenite) was approximately 7.4 million metric tonnes.

• The major TiO2 mineral producers:.

• Rio Tinto, ilmenite mines in Canada and Madagascar.

• Tronox, mines located in South Africa and Australia.

• Kenmare, Moma mine in Mozambique.

• Iluka, mines in Australia and Sierra Leone (West Africa).

• TiZir, Grande Côte operation in Senegal.

• Base Resources, mines in Kenya and Madagascar

Ilmenite price, TiO2 -grade 47–49 %

Ilmenite production by country and company

Global Ilmenite Market

Otanmäki Mine plans to be the first ilmenite producer in the EU-area

Source: Market Data Forecast, Otanmäki Mine Oy, mapsofworld.com, web pages of companies

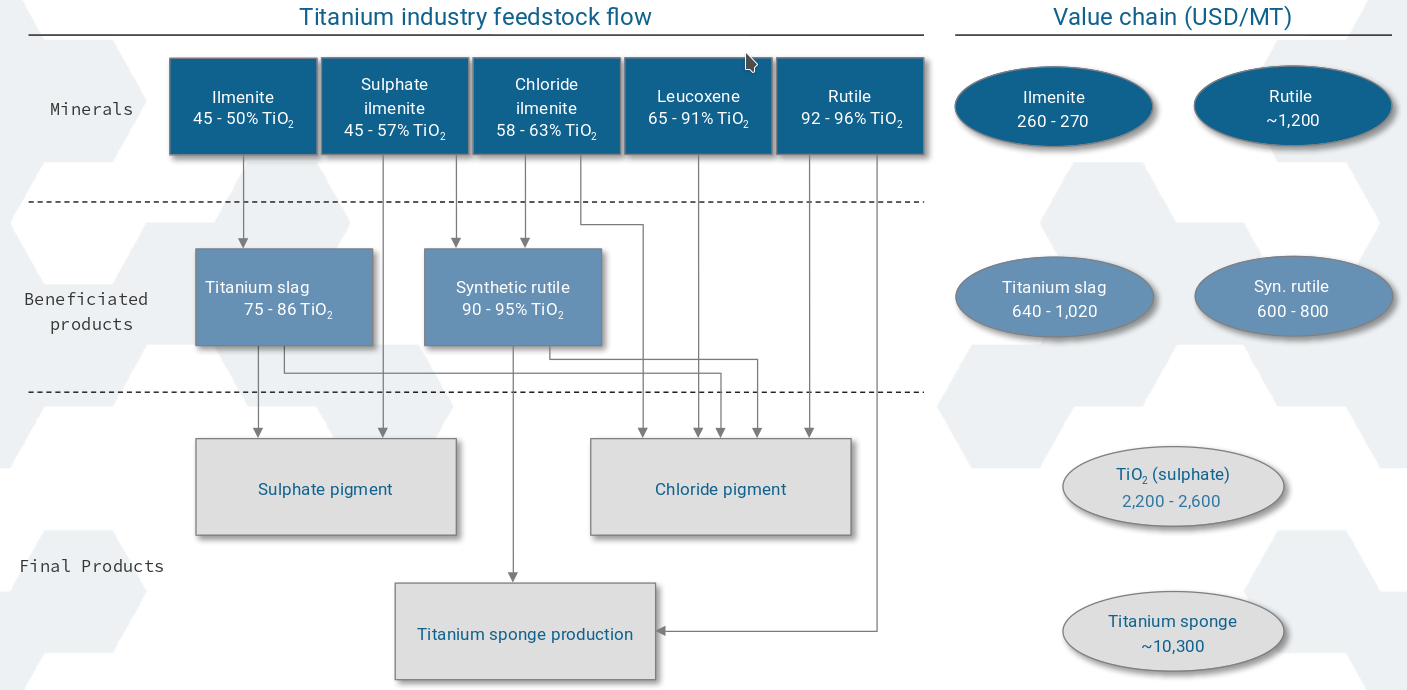

Value Chain of Titanium

Ilmenite is one of the most important raw materials in titaniumdioxide (TiO2) production

Source: INFACON XI, IFAPA, USGS, Metal Bulletin

Facts about titaniumdioxide

• Titanium dioxide (TiO2) is a versatile clear white pigment which is used among other things as the primary base colour in paints, and to provide a clear impression in food colourings and cosmetics

• The unique qualities of TiO2, such as efficiency and UV-protection, make it an important ingredient which offers longevity in sun screen lotions, light reflection coatings, packaging materials, and clothes

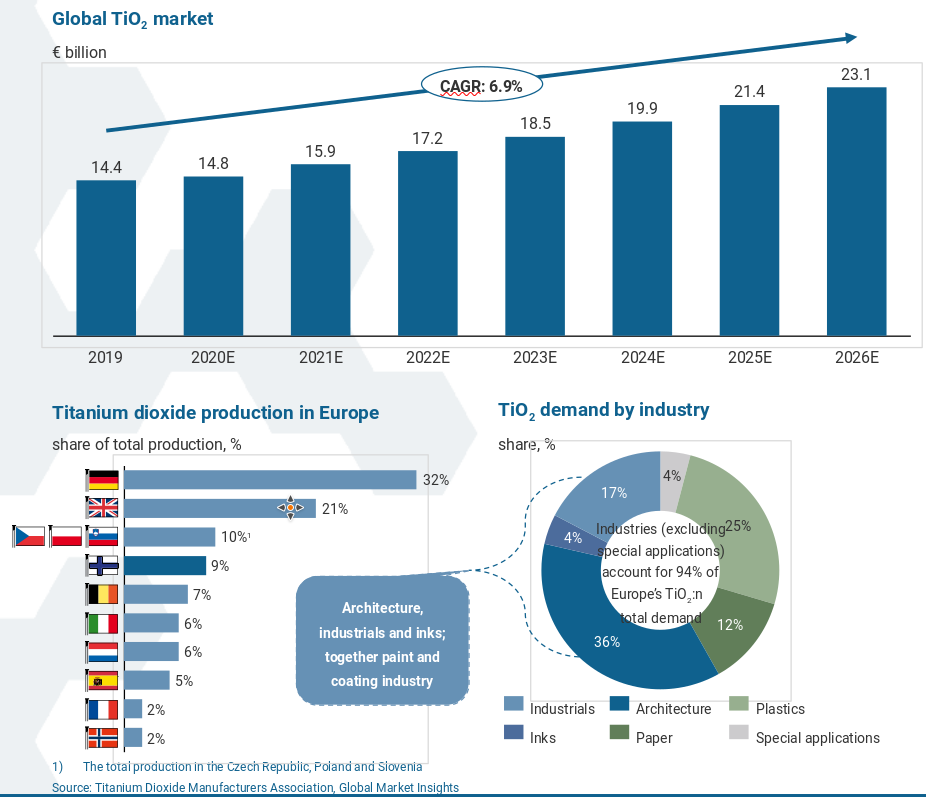

• In 2019, the estimated value of the global titanium dioxide market was €14.4 billion

• From 2020 through 2026, the global titanium dioxide market is expected to grow with an annual growth rate of approximately 7.7%. Market demand is accelerated by the current autonomic cleaning technology trend, and the growing demand in paints & coatings and textile industries

• In the European Economic Area, titanium dioxide is manufactured in 18 different plants. Finland is Europe’s third largest producer (accounting for approx. 9% of Europe’s total TiO2 production)

• The pigment is used in 95% of all manufactured paints, making the paints and coatings industry TiO2’s most important individual final product market

Global Titaniumdioxide Market

1) The total production in the Czech Republic, Poland and Slovenia.

Source: Titanium Dioxide Manufacturers Association, Global Market Insights

European Titaniumdioxide Manufacturers

Otanmäki Mine’s ilmenite will be sold mostly to European TiO2-producers

Source: Otanmäki Mine Oy, Titanium Dioxide Manufacturers Association

Titaniumdioxide Market – Key Growth Drivers

Due to its properties, titanium dioxide is a durable and economically viable solution

Sustainability

• EU has released a strategy for chemical sustainability

• Due to its versatile applications, TiO2’s role in the strategy is extremely essential. As a pigment, TiO2 is safe, and it is used as raw material in thousands of products, e.g. around 95% of all manufactured paints

• The commonly used TiO2 based paints possess high opacity which provides the desired lasting finish with less layers of paint

Circular economy

• EU’s circular economy plans command production resource efficiency, material durability, and waste redundancy. TiO2’s qualities improve our daily consumable products in two fold:

• Efficiency: TiO2’s strong colour, high standards and high opacity empower production resource efficiency

• Durability and protection: TiO2’s high resistance to heat, light and deterioration improve product life-times whilst reducing waste formation

Economical value

• EU accounts for approximately 20% of titanium dioxide’s global production. The market value of this share has been estimated to approximately three billion euros, of which about 68% is sold within the European Economic Area (EEA)

• In 2019, the global titanium dioxide market was valued at approximately €14 billion

• In 2017, the impact of Europe’s titanium dioxide market on global economic growth was approx. €560 million.

• At that time, the industry employed around 8,150 workers in Europe

EU production

• Whereas Europe is one of the world’s largest TiO2 producers, Finland is the third largest producer within Europe, falling behind merely the EEAs largest countries Germany and Great Britain

• Otanmäki Mine will become the sole ilmenite producer in the EU area, and therefore the primary alternative for titanium dioxide manufacturers favouring ETA production

Contact Information

Otanmäki Mine Oy

Kiilakiventie 1, FI-90250 Oulu, Finland

Tel. +358 44 559 3501

jjylanki (at) otanmaki.fi

www.otanmaki.fi